Repayment expression: the amount of time You will need to repay your loan. Deciding on a longer loan term may possibly reduce your monthly payments but could boost the total cost of the loan.

When you conclude the loan comparison section, it is really worth taking into consideration which phrases are best for yourself. Think about your fiscal circumstance And just how the loan may possibly have an effect on you.

Then, run the numbers to make sure you can comfortably manage the monthly payments in your new loan. After you already know specifically the amount of you would like to borrow, Look at diverse lenders to evaluate who may have by far the most favorable loan conditions.

Late payment cost—Lenders can charge a cost for paying also late. Avoid this by simply shelling out all dues promptly. It can help to contact lenders in advance if a payment cannot be built with a thanks day, as some are ready to extend deadlines. This fee can be flat or assessed as a proportion from the payment, dependant upon the lender.

Nonetheless, borrowers Ordinarily really need to pay refinancing expenses upfront. These costs can be very high. Be certain to evaluate the positives and negatives prior to making the refinancing selection.

Funds—refers to some other assets borrowers could possibly have, Besides revenue, that can be made use of to meet a personal debt obligation, like a deposit, personal savings, or investments

Choose this feature to enter a fixed loan expression. As an illustration, the calculator can be used to find out no matter whether a fifteen-yr or thirty-year property finance loan can make more feeling, a standard choice most individuals have to make when getting a house.

Like credit cards or some other loan signed which has a lender, defaulting on personal loans can injury someone's credit rating score. Lenders that look outside of credit rating scores do exist; they use other things such as credit card debt-to-money ratios, secure employment heritage, etc.

Interest rate: the price to borrow funds. It truly is expressed being a proportion with the loan principal. Fascination premiums is often fastened or variable.

To use the calculator, enter the start equilibrium of the loan plus your interest amount. Next, incorporate the minimum amount and the maximum you can pay monthly, then simply click estimate. The results will Allow the thing is the overall desire as well as the regular ordinary for the minimal and greatest payment options.

For instance, This can be a established number of disposable profits based on subtracting expenditures from revenue which can be used to pay again a bank card stability.

Use this calculator for simple calculations of frequent loan forms such as home loans, auto loans, read more scholar loans, or private loans, or click the one-way links For additional detail on each.

Repayment time period: The repayment time period is the number of months or many years it's going to just take to repay your loan.

Completing a loan application will induce a hard inquiry, and your level and phrases might change from any time you prequalified.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Jennifer Love Hewitt Then & Now!

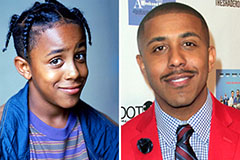

Jennifer Love Hewitt Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!